Recovery rebate credit calculator

Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. See the 2020 Recovery Rebate Credit FAQs Topic A.

Irs Recovery Rebate Tax Credit 2022 How To Claim It Next Year Marca

The taxpayer does not have.

. For filers exceeding the income thresholds above recovery rebates decrease by 5 for every 100 of adjusted gross income. Ad The Recovery Friendly Workplace Tax Credit Is Designed To Reward Eligible Employers. If you claim the head-of.

Ad Pay 0 to File all Federal Tax Returns No Upgrades 100 Accurate. Certain theyhave not received 1st andor 2nd paymentsHelp them calculate their full allowable amount see calculation later. 24 You may be eligible for additional.

These payments are referred to as Economic Impact Payments EIP1s. You can use the Recovery Rebate Credit Worksheet to calculate how much you can claim for your credit if you do not qualify for the stimulus payments. The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020.

February 8 2021. People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return. Scenario 3 Recovery Rebate Credit and a new baby.

The law also provided for an advanced payment of the Recovery Rebate Credit RRC in calendar year 2020. Jo and Nic married in January 2020 and had a baby in October 2020. Use our calculator to find out the amount of your third coronavirus stimulus deadline will be April 15 2022 and request a Recovery Rebate Credit.

Your recovery rebate credit is calculated using a base amount just like the stimulus cheques. If you did not receive a. They were both single on their 2019 returns.

The base credit amount for most persons in 2021 is 1400. The recovery rebate credit is a refundable tax credit that can be claimed on your 2021 return if you did not receive your third stimulus check or received the wrong amount. To see how large your third stimulus payment should have been answer the three questions in the calculator below and well give you a customized estimate.

Premium federal filing is 100 free with no upgrades for premium taxes. However based on the 2020 AGI this single taxpayer will qualify for a further reduced Recovery Rebate on the 2021 Tax Return - around 200. Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund.

99000 maximum for single or married filing single with no children. Recovery Rebate Credit Calculator. If youre married filing a joint tax return or a qualifying widow er the amount of your second stimulus check will drop if your AGI exceeds 150000.

To see how much. Filed skip or leave blank the Recovery Rebate CreditAmount. You must file a 2020 tax return to claim a 2020 Recovery Rebate Credit even if you dont usually file a tax return.

Americans received a tax-free payment from the US government during 2021 to help recover the economy from COVID-19. Ad The Recovery Friendly Workplace Tax Credit Is Designed To Reward Eligible Employers. Most people who are eligible for the Recovery Rebate Credit already received it in advance as two Economic Impact Payments and wont claim it or include.

Residents will receive the Economic Impact Payment of 1200 for individual or head of household filers and 2400 for married filing jointly if they are not a dependent of another. You are able to submit. If your income is 73000 or less you can file your federal tax return.

Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

Expect Refund Delays If You Claimed The Recovery Rebate Credit On Your 2020 Tax Return Donovan

How Much Money You Ll Get From The 2020 Coronavirus Recovery Rebate

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

Recovery Rebate Credit How Much Can I Claim For 2021 Melton Melton

Recovery Rebate Credit H R Block

2021 Taxes And New Tax Laws H R Block

How To Get Your Missed Stimulus Payments Nextadvisor With Time

Xgsd Casyn1udm

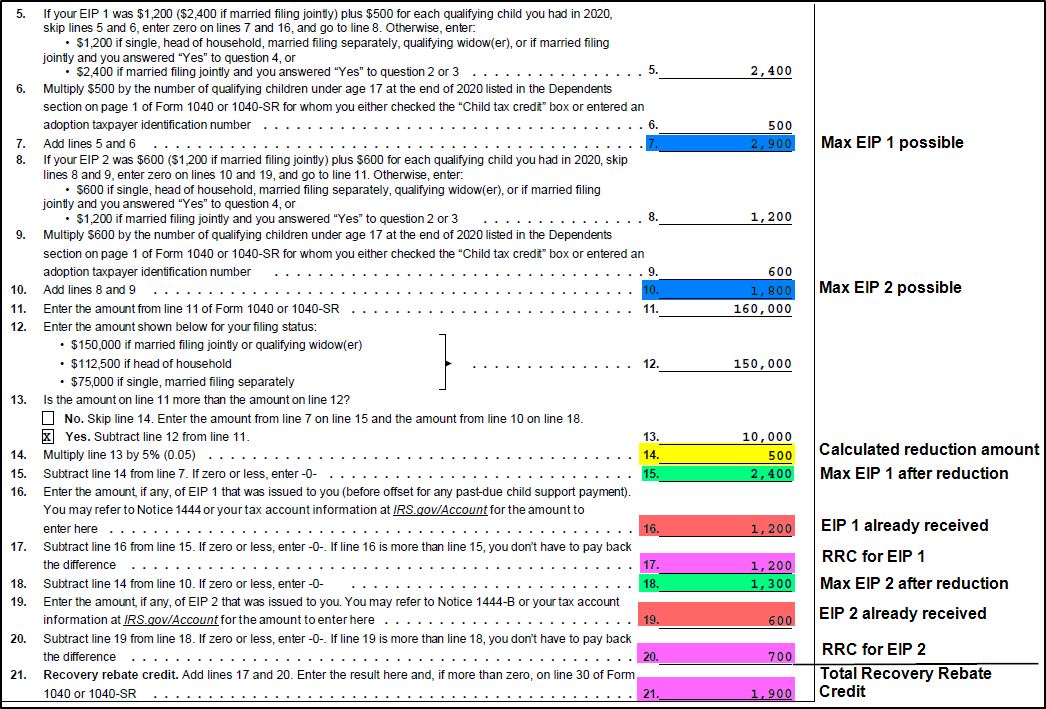

Recovery Rebate Credit Worksheet Explained Support

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

How To Get Your Missed Stimulus Payments Nextadvisor With Time

1040 Recovery Rebate Credit Drake20

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Recovery Rebate Credit 2021 Tax Return

2020 Recovery Rebate Credit Topic G Correcting Issues After The 2020 Tax Return Is Filed Nstp

Recovery Rebate Credit Worksheet Explained Support

How To Get Your Missed Stimulus Payments Nextadvisor With Time